prince william county real estate tax assessment

Provided by Prince William County Communications Office. Prince william county real estate tax assessment Wednesday June 8 2022 Edit.

Prince William Wants To Hike Property Taxes Introduces Meals Tax

These candidates tax assessments are then matched.

. Report changes for individual accounts. Free Comprehensive Details on Homes Property Near You. Ad Unsure Of The Value Of Your Property.

Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of. Press 1 to pay Personal Property Tax. For more information please visit Prince William Countys Department of Real Estate Assessments or look up this propertys current valuation.

Find All The Record Information You Need Here. Enter the Tax Account numbers listed on the billing statement. July 2 2022.

All you need is your tax account number and your checkbook or credit card. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes. Hi the county assesses a land value and an improvements value to get a total value.

They are a valuable tool for the real estate industry offering. The Ultimate Guide to the Prince William County Property Tax Assessments. How property tax calculated in pwc.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. If you own real property in Prince William County you need to know how property tax assessments work. You can pay a bill without logging in using this screen.

Enter the Account Number listed on the billing statement. By creating an account you will have access to balance and account information notifications etc. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

Report a Change of Address. Then they get the assessed value by multiplying the percent of total value assesed currently 100. If you have questions about this site please email the Real Estate Assessments Office.

Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County. See Results in Minutes. If you have not received a tax bill for your property and believe you should have contact the Taxpayer Services Office at 703-792-6710 or by email at email protected.

Due to the low tax rate. You will need to create an account or login. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

Compare The Best Local Appraisers With Reviews From Your Neighbors. Learn all about Prince William County real estate tax. Enter jurisdiction code 1036.

Moving a vehicle INTO Prince William County from another state please register your vehicle and change of address with the Virginia Department of Motor Vehicles DMV 804. The extension applies to both commercial and residential real property. Prince William County Virginia Home.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Press 2 for Real Estate Tax. Click here to register for an account or here to login if you already have an account.

What is the property tax rate in Prince William County VA. Dial 1-888-2PAY TAX 1-888-272-9829. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

You will need to create an account or login. A convenience fee is added to payments by credit or debit card. Then they multiply that by the tax rate to get your property tax.

The Taxpayer Services in-person and telephone office hours are Monday Tuesday Thursday and Friday from 800. Enter street name without street direction NSEW or suffix StDrAvetc. They are maintained by various government offices in Prince William County Virginia State and at the Federal level.

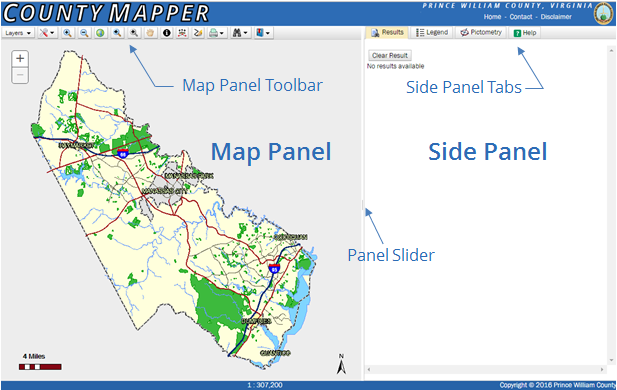

We strive to provide the best customer service to Prince William County residents through our Taxpayer Services Division comprised of our Service Counters Call Center email website and tax portal. Use both House Number and House Number High fields when searching for range of house numbers. Make a Quick Payment.

Learn all about Prince William County real estate tax. Certain types of Tax Records are available to the general public while some Tax Records are only available by making a Freedom of Information Act FOIA request to access public records. Expert Results for Free.

Payment by e-check is a free service. Ad Angi Matches You to Experienced Local Appraisers In Minutes. The system will verbally provide you with a receipt number for you to write down.

Siga las instrucciones e ingrese el codigo de jurisdiccion 1036 para seleccionar el. Ad Just Enter your Zip for Real Estate Assessments in Your Area. When prompted enter Jurisdiction Code 1036 for Prince William County.

00001 per 100 of assessed value for property tax classifications listed below no tax bills are generated if the assessed value is 50000000 or less. You can read more at Propety Taxes in. Enter Any Address Receive a Comprehensive Property Report.

919 Prince Street Harris County Houston TX 77008. Enter your payment card information. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs.

Every homeowner needs to pay taxes but not many states have low property tax ratesThis is why you have many ways to lower your tax bills from applying for a property tax exemption to. Press 2 to pay Real Estate Tax. Enter the house or property number.

Often a resulting tax assessed. Press 1 for Personal Property Tax. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Para pagar por telefono por favor llame al 1-800-487-4567.

Rural Crescent In Prince William County

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Class Specifications Sorted By Classtitle Ascending Prince William County

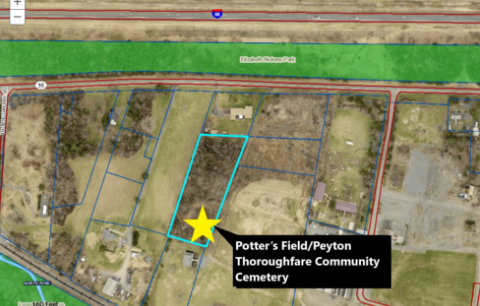

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

Prince William Supervisors Set To Approve Tax Hikes For Residents Restaurant Customers Tuesday

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

The Rural Area In Prince William County

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Pathway To 2040 Small Area Planning

Land For Sale In Prince William County Va Homes Com

Landfill And Compost Facility Safety Guidelines

Bland Family Of Stafford Prince William Loudoun Co S Va And Edgefield County Sc Goyen Family Tree

When Are Prince William County Real Estate Taxes Due S Ehrlich